Equity

Over the past eight year investors have enjoyed a relatively one directional bull market as Central Bank involvement in financial markets led to artificially low volatility. This has not been the case so far this year, as equity markets have experienced an uptick in volatility with performance varied across regions.

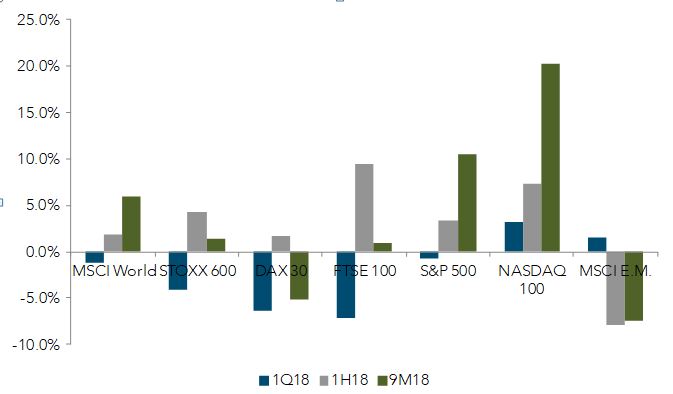

US equities have been amongst the top performers on a year to date (“YTD”) basis with a clear preference for growth stocks. The S&P 500 and Nasdaq gained 10.6% and 20.2% respectively from the beginning of the year to the end of Q3. The US economy held steady during the first nine months of the year despite concerns of a potential slow down at the start of the year, with the economy seemingly operating at/close to full employment. Unemployment remained low at 3.9% whilst inflation stood at 2.2% in August. The biggest risk for the US economy remains a misstep in policy. Additionally, the discussions and announcements around tariffs is also clouding the outlook.

Europe has been a clear laggard as concerns over possible trade wars and the lack of meaningful developments over Brexit have weighed on the European equity market with the DAX 30 down 5.2% YTD. The EU’s macro-economic performance was positive last year, growing 2.4% after many years of lacklustre growth. However, weaker than expected economic data releases this year have led to suggestions that while growth will continue, it will be lower than the lofty expectations at the start of the year, with this seemingly confirmed by PMI’s trending lower. The negative sentiment has been further aggravated by increased political instability in regions such as Italy, deteriorating trade relationships with the US and Merkel’s weak political position. On the other hand, EU unemployment continued to decline which should act as a support for the European Economy. The improving employment situation, as well as other factors like higher oil prices, has led to an uptick in inflation over the past years. The improvement in the labour market bodes well for Europe’s macro-economic prospects and will provide support to the consumer discretionary sector whilst the uptick in inflation could be positive for bank stocks.

Source: Bloomberg

The information presented in this commentary is solely provided for informational purposes and is not to be interpreted as investment advice, or to be used or considered as an offer or a solicitation to sell/buy or subscribe for any financial instruments, nor to constitute any advice or recommendation with respect to such financial instruments. Curmi and Partners Ltd. is a member of the Malta Stock Exchange, and is licensed by the MFSA to conduct investment services business.