by Robert Ducker

At the time of writing, the ECB is widely expected to cut interest rates further and possibly re-introduce the asset purchase programme in an effort to stimulate the region’s fading economy. Germany in particular has been hit hard by developments in the auto industry (emissions testing), global trade tensions (US and China trade talks) and Brexit uncertainty. Whether a further interest rate cut on its own will help boost the region’s economy is up for debate, but there is one sector that could do without a rate cut: Banks. The main reasons for this are described below.

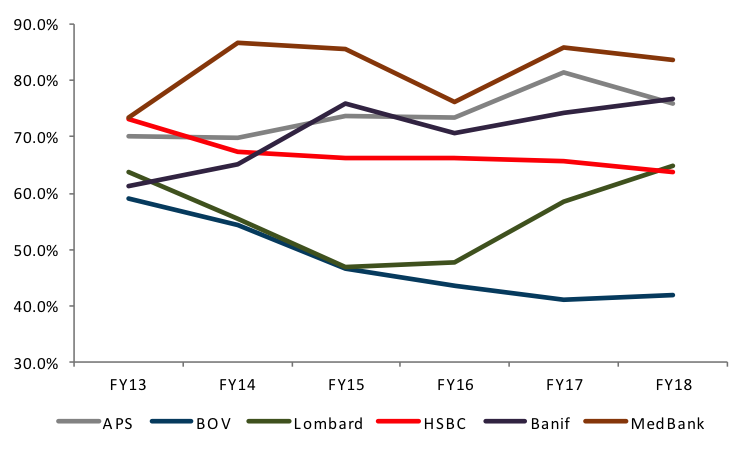

Local Banks (“Local Banks” refers to APS, Banif, BOV, Lombard, MeDirect and HSBC) are flushed with liquidity and the introduction of negative interest rates in 2014 has had a significant impact on financial performance. The average loan to deposit ratio of Local Banks, a ratio that measures a bank’s liquidity by comparing customer loans to deposits, stood at 67.8% at the end of 2018, slightly above the five year average of 66.2%. In other words, Local Banks have been able to loan out just under 68% of the funds received on deposit. By way of comparison, the average loan to deposit ratio for European Banks according to data provided by the European Banking Authority stood at 117.1% at the end of 2018.

While excess liquidity in the form of deposits is a positive in terms of solvency, the current low yield environment leaves banks with very limited options. This excess liquidity could be invested in negative yielding debt securities, lending to other banks or park these funds with the Central banks at a charge of 0.4%. The low unemployment rate in Malta and the solid economic performance have led to a 54.5% increase in deposits at Local Banks over the past five years, whilst loan books have grown by 32.7%, perhaps reflecting the non capital hungry nature of economic growth we have witnessed recently. One other influencing factor creating this disparity is the increased regulation and capital requirements. Local Banks have to hold more capital because of concentration risk, both in terms of geography and loan book exposures.

Local Banks operate mostly in Malta and therefore any deterioration in economic conditions could have an impact on their performance and credit quality. As for loan book exposure, Mortgages make up a large proportion of a Local Bank’s loan book exposure. There has been a lot of noise around real estate valuations in recent years but it is worth noting that historically the default rates on mortgages have been insignificant.

On a more social aspect, bearing in mind the risk tolerance for an average local investor, fixed deposits were considered to be an important investment product for a significant portion of the population. In today’s low yield environment individuals who rely on deposit interest income have been hit hard and this will continue to be the case in the short term unless they are prepared to increase their risk tolerance.

From a financial point of view, Local Banks have reported a 15.6% drop in pre-provision profits over the five year period to 2018, as the growth in operating costs (+18.6%) has outweighed the growth in operating income (+3.2%). A rough estimate of the impact from negative interest rates on net interest income, in 2018, amounted to circa €20million in aggregate, and assuming no changes to the Local Bank balance sheet, could rise to €25million in case of a 10bp cut by the ECB on Thursday. Bearing in mind the impact on the European banking system, the ECB could introduce a system whereby the amount of excess reserves subject to negative interest rates is reduced. This system, called tiering, has been implemented in other countries like Switzerland, Japan, Denmark and Sweden. In Switzerland, after negative rates were introduced in 2015, the SNB introduced a system whereby Swiss banks are only charged negative rates if the deposit account balances at the SNB exceed a threshold (20 times their minimum reserve requirement). It remains to be seen whether a tiering system is introduced by the ECB and what impact, if any, it would have on Local Banks.

The loose monetary policy adopted by Central Banks over the past decade, coupled with increased regulation (and costs) and capital requirements have made business more cumbersome. One would hope that any additional interest rate cuts would come with some mitigation measure of sorts. No matter what, the solvency of Local Banks remains solid.

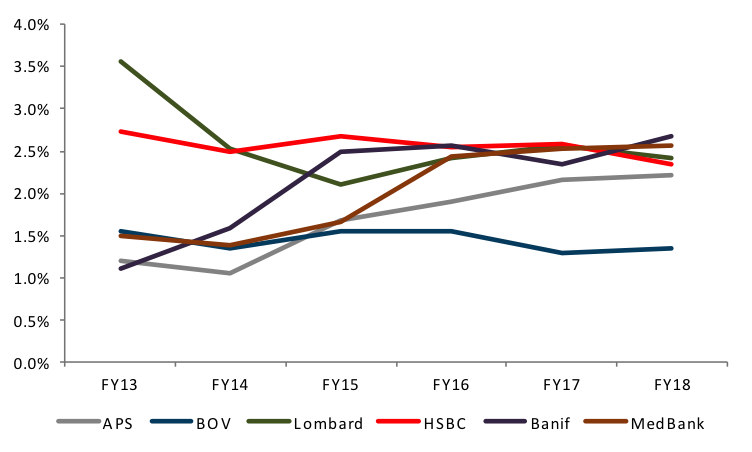

Exhibit 1

Net interest income from lending operations (estimate)

Source: Financial statements, C&P workings

Exhibit 2

Customer loans to deposits ratio

Source: Financial statements, C&P workings

The information presented in this commentary is solely provided for informational purposes and is not to be interpreted as investment advice, or to be used or considered as an offer or a solicitation to sell/buy or subscribe for any financial instruments, nor to constitute any advice or recommendation with respect to such financial instruments. Curmi and Partners Ltd. is a member of the Malta Stock Exchange, and is licensed by the MFSA to conduct investment services business.