Company Profile

Harvest Technology plc (“Harvest” or “the Issuer”) operates within the Information Technology and e-Commerce space and acts as an investment and holding company. It primarily conducts its business in Malta but also has operations in parts of Europe and Africa.

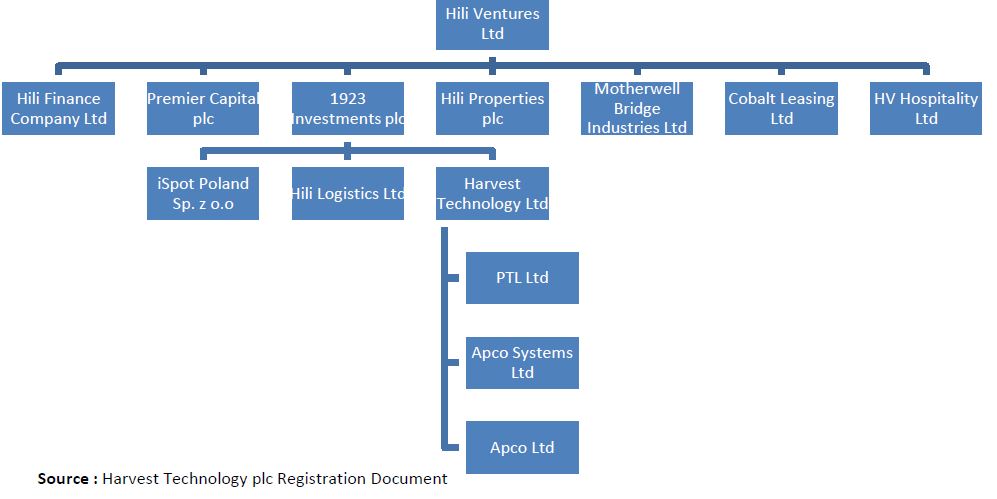

The Issuer forms part of the group structure (see below) of Hili Ventures Limited (“Hili Ventures”) through the subsidiary 1923 Investments plc. Harvest owns and operates three different and distinct subsidiaries: PTL Limited, Apco Systems Limited and Apco Limited.

PTL

PTL Limited

PTL Limited (“PTL”), formerly known as Philip Toledo Limited prior to its acquisition by the Hili Group in 2012, has been in operation since 1976 and is a multi-brand technology solutions provider representing such brands as NCR, Microsoft, Cisco, Oracle, Lenovo and IBM. PTL’s operations are comprised of four segments: Hardware & Software Solutions, Software Engineering, Technical Services and Nearshoring Services.

Apco Limited

Apco Limited (“Apco”) was established in 1984 and is a supplier of a wide range of automation and security solutions. It offers a number of products including point of sale systems, CCTV systems, safes, and outdoor payment terminals. Apco targets businesses that operate within the retail, banking, security and fuel industries. Apco Limited was acquired by the Hili Group in 2014.

Apco Systems Limited

Apco Systems Limited (“Apco Systems”) was incorporated in 2001. It operates under the Apcopay brand and provides payment solutions to retailers and internet-based merchants. Operating in 25 countries, Apco Systems boasts of more than 1,200 merchants with major clients including public sector entities and gaming related companies. Apco Systems generates revenues through fees on a “per transaction” basis either as a percentage of the transaction value or a specified fee per transaction.

Initial Public Offer

Harvest Technology plc has a total of 22,780,636 shares outstanding of which 20,502,574 (90% of the shareholding) are held by 1923 Investments plc and the balance by Prof. Juanito Camilleri. Through the Initial Public Offering (“IPO”) 9,112,256 shares will be offered to the general public representing a 40% ownership stake in Harvest. 1923 Investments plc will retain 56% of the issued shares while Prof. Juanito Camilleri will retain 4% of the issued shares. The shares will be offered at a price of €1.50 per share for a minimum of 1,000 shares (and in multiples of 100 shares thereafter) per application.

Financial Highlights

In 2018, Harvest reported revenues of €15.6 million as gross profit amounted to €5.7 million due to cost of sales of €9.89 million. The company reported net profit of €0.60 million for the financial year ending 31st December 2018 as earnings per share amounted to 2.6 cents per share.

Going forward, management expects revenue to increase as it is being projected that Harvest should achieve revenues of €15.4 million in 2019, € 21.4 million in 2020 and €18.3 million in 2021. Net Income is also expected to grow as management projects that net profit should reach €1.6 million in 2019 and €2.2 million in 2021.

The growth is expected to result from each of the three underlying businesses' revenue growth and cost reduction. Cost of sales is expected to increase from €9.9 million in 2018 to €10.4 million in 2021 while Administrative Expenses are projected to decrease from €4.3 million in 2018 to €3.4 million in 2021.

|

2016 |

2017 |

2018 |

2019P |

2020P |

2021P |

| Revenue |

10,195 |

13,087 |

15,569 |

15,416 |

21,367 |

18,251 |

| Gross Profit |

2,940 |

4,582 |

5,681 |

6,527 |

8,149 |

7,803 |

| EBITDA |

863 |

1,180 |

1,356 |

3,167 |

4,401 |

4,361 |

| Net Income |

95 |

325 |

581 |

1,561 |

2,040 |

2,219 |

| Earnings per Share |

1.4c |

1.4c |

2.6c |

6.9c |

9.0c |

9.7c |

Source : Harvest Technology plc Registration Document – All figures except for Earnings per Share are in euro thousands

Dividend Policy

The Board of Directors (“BoD”) has indicated that a 4.00% net dividend yield will be distributed to shareholders with the first payment, an interim dividend, to be paid following the approval of the June 2020 interim financial statements. Going forward, it is the BoD’s intention to pay two dividends a year with an interim dividend of €544,000 and a final dividend of €816,000 expected in 2021.

|

2018 |

2019 |

2020P |

2021P |

| Dividends Distributed |

€750,000 |

€951,000 |

€543,000 |

€1,360,000 |

| Dividends per share |

3.3c |

4.2c |

2.4c |

6.0c |

Source : Harvest Technology plc Registration Document

Application Forms & Timetable

As per the table below, the application forms will be made available on the 26th of November with the offering period coming to a close on the 2nd of December. There are two forms that interested applicants can use to participate in the IPO. Application Form A should be used by employees and directors of any company forming part of the Hili Ventures Group, while Application Form B should be used by the general public.

Curmi & Partners Limited will be participating in the Intermediaries Offer of the Initial Public Offering. Should you be interested in participating, kindly contact us on +356 2134 7331 or via email on info@curmiandpartners.com.

| Availability of Application Forms |

26th November 2019 |

| Placement Date (at 14:00 hours) |

2nd December 2019 |

| Closing of Offer Period |

12th December 2019 |

| Announcement of basis of acceptance |

20th December 2019 |

| Refund of unallocated monies (if any) |

6th January 2020 |

| Dispatch of allotment advices |

6th January 2020 |

| Expected date of submission of the shares to listing |

6th January 2020 |

| Expected date of commencement of trading in shares |

7th January 2020 |

Disclaimer

The information presented in this note is provided on a non-independent basis and is solely provided for informational purposes and is not to be interpreted as investment advice, or to be used or considered as an offer or a solicitation to sell, or an offer or solicitation to buy or subscribe for any financial instruments, nor to constitute any advice or recommendation with respect to such financial instruments. To the extent that you rely on the Information in connection with any investment decision, you do so at your own risk. The Information does not purport to be complete on any topic addressed. The Information may contain data or analysis prepared by third parties and no representation or warranty about the accuracy of such data or analysis is provided. The prospectus used for the preparation of this document is still due for approval by the Listing Authority and is thus still subject to alterations. Curmi and Partners will advise its clients if any material changes are made upon final approval of the prospectus. In all cases where historical performance is presented, please note that past performance is not a reliable indicator of future results and should not be relied upon as the basis for making an investment decision. Investors may not get back the amount originally invested. The value of investments can fall as well as rise and past performance is no indication of future performance. The Information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use is contrary to law, rule or regulation. Certain information contained in the Information includes calculations or figures that have been prepared internally and have not been audited or verified by a third party. Use of different methods for preparing, calculating or presenting information may lead to different results. Curmi and Partners Ltd. is a member of the Malta Stock Exchange, and is licensed by the MFSA to conduct investment services business.