By Simon Gauci Borda

Asset Class Performance

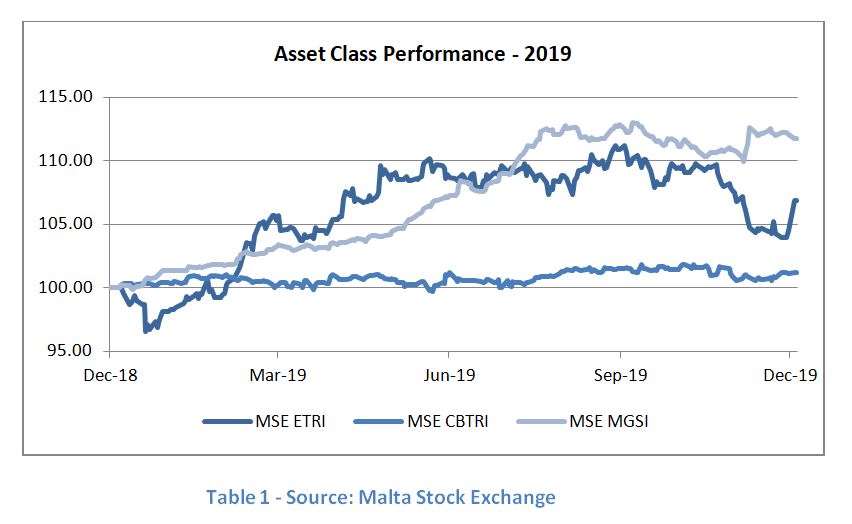

The Malta Stock Exchange (“MSE”) publicly issues data on the performance of the three main segments that make up the local financial markets by means of total return indices. These are the MSE Equity Total Return Index (“MSE ETRI”), the MSE Corporate Bonds Total Return Index (“MSE CBTRI”) and the MSE Malta Government Stocks Index (“MSE MGSI”). The MSE ETRI tracks local equities, the MSE CBTRI tracks local corporate bonds while the MSE MGSI tracks the local government bond market.

As per the chart below, during 2019, the best performer amongst the three total return indices tracked by the MSE was the MSE MGSI with a total return of 11.78%, with the MSE ETRI and the MSE CBTRI returning 6.85% and 1.19% respectively. While the performance of these total return indices paint a broad picture of each asset class’s performance, it is important to note that they are not directly comparable. The MSE CBTRI and MSE MGSI only track a portion of the total market (with each tracking the top fifteen securities of the respective market) whereas the MSE ETRI tracks the entire local equity market.

MSE Trading Activity

During the period under review, as per the table below, trading activity on the MSE was that of €487.6 million over 29,290 individual trades, an increase of €94.9 million or 24.2% compared to the prior year. As in previous years, the bulk of the trading volume on the MSE was driven by Malta Government Stocks (“MGS”). Trading within the MGS market is more liquid than the other two markets as the Central Bank of Malta (“CBM”) acts as a market maker for MGS. Also, the MGS market is the largest of the three markets with an outstanding nominal amount (i.e. issue size) of almost €5.0 billion.

One will also deduce from the table below that while trading in the equity and corporate bond markets have increased in the last five years, trading in the MGS market has dropped from a high of €777.0 million in 2015 to €302.3 million in 2019. The decline in trading volume of MGS could be due to the reduction in the net issuance of Government debt and the decrease in liquidity given that the CBM purchased large amounts of MGS in recent years. The increase in trading volume within local equities and corporate bonds over the past five years could be attributed to the new issues brought to market, particularly within the corporate bond market.

|

Trading Value in Millions

|

|

Year

|

Equities

|

Corporate Bonds

|

Malta Government Stocks

|

Total

|

|

2015

|

€ 81.5

|

€ 59.8

|

€ 777.0

|

€ 918.2

|

|

2016

|

€ 77.8

|

€ 57.9

|

€ 551.8

|

€ 687.4

|

|

2017

|

€ 88.0

|

€ 80.5

|

€ 403.8

|

€ 572.3

|

|

2018

|

€ 86.3

|

€ 93.7

|

€ 212.7

|

€ 392.7

|

|

2019

|

€ 89.2

|

€ 96.0

|

€ 302.3

|

€ 487.6

|

Table 2 - Source: Malta Stock Exchange

New Issues and IPOs

During 2019 the local financial market grew in size as more issuers opted to raise capital. In the equity space there was the Initial Public Offering (“IPO”) of BMIT Technologies plc while in the corporate bond market thirteen issuers came to market, six of which were debutants. Total issuance in the local equity market was just shy of the €50.0 million mark, while total issuance in the local corporate bond market and MGS market was that of €377.6 million and €352.0 million respectively.

Outlook for 2020

With the MSE and Treasury Department yet to publish their indicative listing calendar and Annual Borrowing Plan for 2020 respectively (which is usually done towards the end of January), it would be presumptuous to attempt forecasting the amount of new issues which may be brought to market. However, there are two issuers that have already publicly disclosed that they will be raising capital on the local market. AX Group plc announced that it intends to raise capital in both the equity and bond market while Bank of Valletta plc has also stated that it intends to tap the local corporate bond market. Earlier this year, on the 6th of January, Harvest Technology plc (a subsidiary of the Hili Ventures Group) listed 30% of its share capital on the local equity market.

The information presented in this commentary is solely provided for informational purposes and is not to be interpreted as investment advice, or to be used or considered as an offer or a solicitation to sell/buy or subscribe for any financial instruments, nor to constitute any advice or recommendation with respect to such financial instruments. Curmi and Partners Ltd. is a member of the Malta Stock Exchange, and is licensed by the MFSA to conduct investment services business.