By Noelle Cauchi

Negative interest rates, a stagnant economy, low inflation, Brexit, and trade wars were the main themes which characterised the European economy in 2019. In response, the European Central Bank (“ECB”) acted to save the economy from going further downhill.

Over the first six months of the year, the Eurozone’s economy was close to stalling and the market even feared a recession in Germany. Globally, trade tensions between US and China remained a concern. The German 10-year Bund yield went to record lows (-0.714% in August) and the benchmark yield curve continued to flatten. Up until June, the ECB had indicated that ECB interest rates would remain unchanged at least through the first half of 2020. However, these ongoing events led the Governing Council (“GC”) to decrease the deposit rate by 10 basis points to -0.50%.

The GC also announced that it will be re-launching quarterly targeted longer-term refinancing operations (“TLTRO-III”) in September. TLTROs provide financing to credit institutions; encourage bank lending to the real economy. A first series of TLTROs was announced in June 2014, a second series in March 2016 and a third series in March 2019. In the Q4 2019 Bank Lending Survey, respondent banks reported that TLTRO-III operations had a positive impact on their overall financial situation, particularly with regards to liquidity and market financing conditions. Credit institutions can also benefit from other measures introduced by the ECB such as the two-tier system.

The ECB also restarted Quantitative Easing (“QE”) last year after it had ended the programme in December 2018. QE is a monetary policy in which central banks aim to increase money supply, encouraging lending and investment by purchasing securities from the market. In September, the ECB announced an Asset Purchase Programme (“APP”) whereby the GC will be making net purchases at a monthly pace of €20 billion from November. This APP programme includes the third covered bond purchase programme, the asset-backed securities purchase programme and the corporate sector purchase programme. A number of APPs had already been conducted in the Eurosystem between October 2014 and December 2018 which resulted in the Eurosystem’s balance sheet increasing by 117% to €4.7trillion.

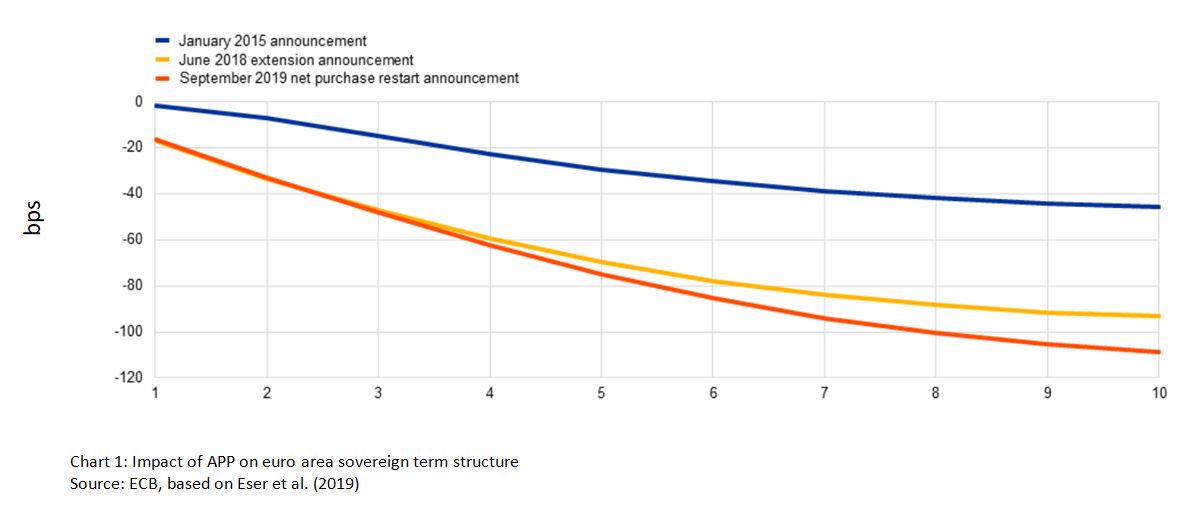

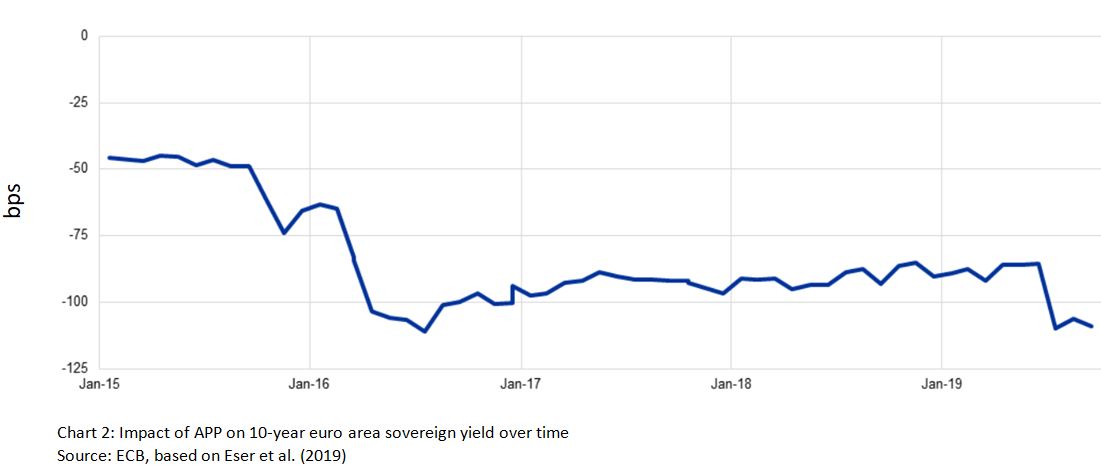

Deposit rate changes usually have an impact on the shorter end of the yield curve whereas QE usually impacts the longer end. Asset purchases decrease the overall duration risk to be absorbed by private investors thereby reducing the term premium for longer term bonds. A number of studies show that yields fell significantly across all financial market segments following APP announcements in previous years, and has remained a considerable source of financial easing after the end of net purchases. This is evidenced in Chart 1 which shows how much previous APPs have compressed the yield curve in the euro area, and in Chart 2 which shows the impact of APP on 10-year euro area sovereign yield over time. By providing accommodation in an environment of increased downside risks to growth, APP has previously supported the sustained convergence of inflation to levels closer to the target rate.

Q4 2019 saw some signs of improved sentiment; global bond yields generally climbed from the low levels in previous months and the market seemed to be pricing in less additional accommodation by the ECB. More recently, a Phase 1 deal has been signed between US and China and uncertainties relating to Brexit have decreased. Nonetheless, the pace of economic activity has remained subdued. ECB projects that real GDP growth will decline slightly to 1.1% and inflation is also expected to slow further in 2020.

During 2019, the ECB President Mario Draghi was replaced by Christine Lagarde. In the first monetary policy meeting for 2020, key ECB interest rates remained unchanged and it was established that the APP will keep on running. The GC also announced the launch of a strategic review of the ECB’s monetary policy until the end of 2020. The review will look at price stability, the monetary policy toolkit, economic and monetary analyses, communication practice and financial stability, employment and environmental sustainability. Lagarde has maintained Draghi’s view that supportive fiscal policy can complement monetary policy, stating that “Governments with fiscal space should be ready to act in an effective and timely manner”.

Although it is difficult to forecast how the Eurozone economy will change in 2020, it seems that the measures taken by the ECB in 2019 have managed to combat the rough waters that the economy was going through. The US economy is expected to pick up steam more rapidly than the European economy this year, which may have an impact the ECB’s decisions. The strategic review may bring about some new changes too. It would be interesting to see the impact of these changes in the next couple of years.