Article by Noelle Micallef

“We’re not even thinking about, thinking about raising rates”. These are the words Jerome Powell, US Federal Reserve (“the Fed”) Chairman, uttered during the latest policy meeting on 10th June. Although Donald Trump has been nudging the Fed to consider negative interest rates, even calling it a “gift” in one of his tweets, Powell seems intent on such rates not becoming a measure that the Committee would look into.

Negative interest rates are an unconventional monetary policy tool whereby central banks set target interest rates below the theoretical lower bound of 0%. In this environment, banks charge you for storing money with them. This is done to drive demand for loans, encouraging investment and consumer spending. A negative interest rate policy is a reaction to severe economic troubles but could also be expected to have certain harmful side effects on pension funds, investors, banks, and insurers.

The Fed lowered its benchmark interest rates to a range of 0%-0.25% in mid-March, as one of the earliest moves to cushion the economy against the economic toll caused by Covid-19. Since then, the Fed utilised several tools to support the economy, and is considering the introduction of outcome-based forward guidance paired with yield curve control. However, the Committee is adamant that negative rates hurt banks and disrupt lending.

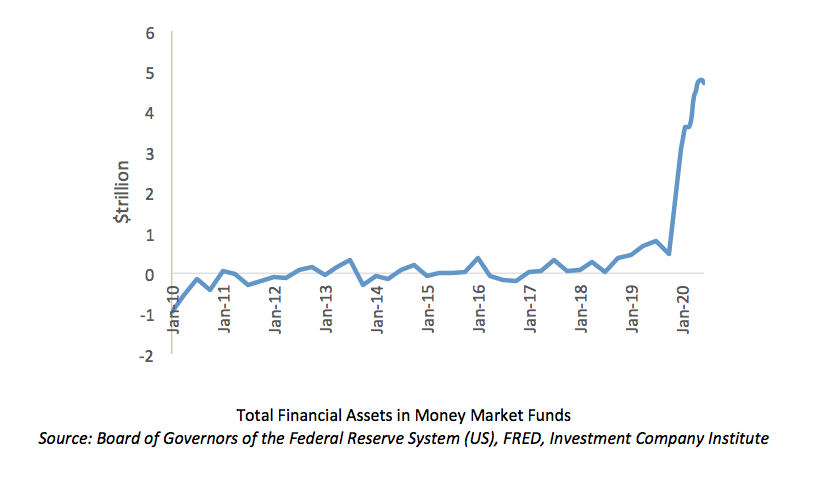

Negative rates have the largest, immediate impact on short-term rates, potentially causing great disruptions in the US money market, which carries out the largest volume of such transactions in the world. In May, assets in money market funds soared to a record $4.77trillion, as investors sought safer investments. If the interest income that these markets provide are lower than zero, investors could start seeking yield elsewhere. Whilst it is true that the Fed’s actions have limited the tightening of financial conditions so far, it is not yet clear whether these tools provide the right amount of easing.

Outside the US, negative interest rates are no longer a novel monetary policy tool. The European Central Bank (“ECB”) pushed short-term interest rates below zero in 2014, lowering the deposit rate to -0.1% to deal with the aftermath of the global and sovereign debt crises. Currently, rates are even lower with a deposit facility at -0.5%. The Bank of Japan adopted negative interest rates in January 2016, mainly to portect the export-oriented economy against a strenghtened Japanese Yen. In May, the Bank of England’s governor, Andrew Bailey, said that the Bank would be “foolish” to rule things out as a matter of principle.

After six years, the European experience suggests that negative rate doom-mongers have been wrong. So far, the ECB’s negative rates have resumed bank lending and drove unemployment down, lifting the eurozone out of a potential deflationary spiral. Negative interest rates have supported the economic activity; ultimately contributing to price stability (Boucinha and Burlon, 2020). This resulted in higher lending volumes and improved creditworthiness of borrowers, thereby mitigating the impact of lower interest margins on overall bank profitability. When banks are sound, negative interest rates can provide stimulus to the real economy by influencing the behaviour of banks and firms (Altavilla et al., 2019). Nonetheless, the Swedish central bank, which introduced negative rates in 2009 and in 2015, has acknowledged that such rates might cause long-term problems.

The implications of a negative interest rate policy are still unknown in the US as the country does not have enough historical experience. According to Powell, the nation’s path forward remains “highly uncertain and subject to significant downside risks”. Only time will tell whether such uncertainty and pressure from the White House will eventually push the Fed to use the “gift” and break the stigma against negative rates in the US.

The information presented in this commentary is solely provided for informational purposes and is not to be interpreted as investment advice, or to be used or considered as an offer or a solicitation to sell/buy or subscribe for any financial instruments, nor to constitute any advice or recommendation with respect to such financial instruments. Curmi and Partners Ltd. is a member of the Malta Stock Exchange, and is licensed by the MFSA to conduct investment services business.