By Noelle Cauchi

Since its first appearance in December 2019, COVID-19 has rapidly circled the globe and eventually affected every continent except Antartica. In general, pandemics are not only a serious public health concern, but also trigger disastrous socio-economic and political crisis in all infected countries.

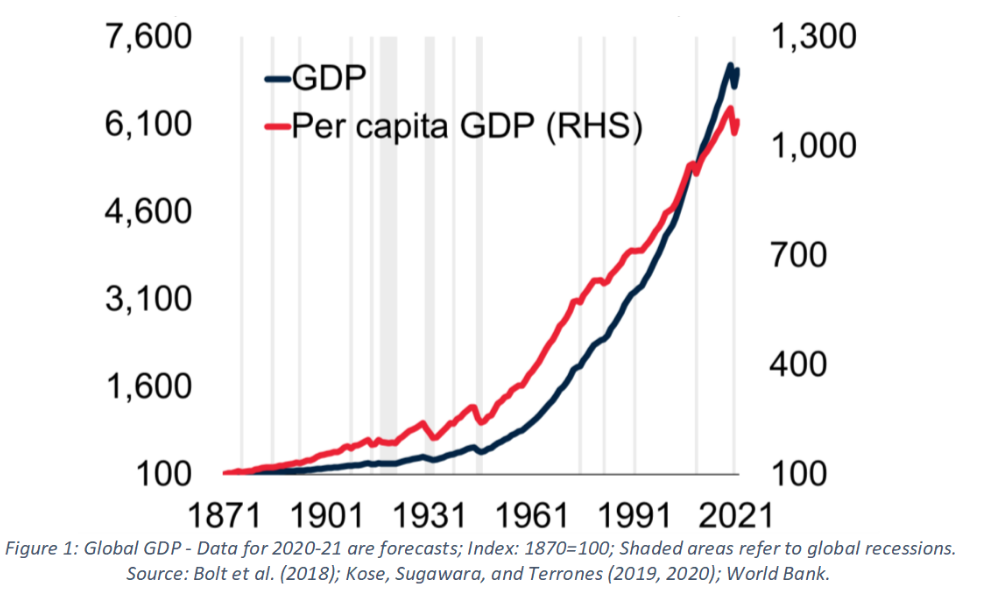

The COVID-19 pandemic and the economic shutdown worldwide have disrupted billions of lives and jeopardizes decades of development progress. As per the European Commission’s Summer 2020 Economic Forecast, published on 7th July, the EU economy is forecast to contract by 8.3% in 2020, then grow by 5.8% in 2021. The global economy has experienced 14 global recessions since 1870. As indicated in the chart below, World Bank projects that the COVID-19 global recession will be the fourth deepest during this period, and the most severe post-World War II.

In view of the serious disturbance caused by the pandemic, the European Commission (“EC”) set up the Temporary Framework for State Aid measures to support the economy in the current COVID-19 outbreak. The aim of this framework is to remedy the liquidity shortage faced by undertakings and ensuring that the disruptions caused by the outbreak do not undermine undertakings, especially Small and Medium Enterprises. This framework is separate from the additional funding introduced by European institutions to mitigate monetary policy, to aid hospitals and to develop a vaccine.

The temporary framework includes aid in the form of direct grants, repayable advances or tax advantages, aid in the form of guarantees on loans, aid in the form of subsidised interest rates for loans, guarantees and loans channelled through credit and financial institutions, aid for wage subsidies for employees to avoid lay-offs during the pandemic and aid for COVID-19 research, development and products. Certain conditions need to be satisfied to be granted this aid and is available till 31st December 2020, unless further extended by the EC.

In Malta, the outbreak brought several sectors which drive the economy to a complete standstill. The economic repercussions may be disproportionately high for a country which is highly dependent on foreign trade and tourism. The pandemic has also exerted its impact on the Maltese capital markets, which has a reputation of retaining stability even during financial crises. The corporate bond index on the Malta Stock Exchange showed a sharp decrease in investor confidence, especially during March to April 2020.

In view of this, the Malta Development Bank (“MDB”) has implemented the EC’s temporary framework to offer three schemes to local businesses hit by the outbreak, namely the following:

- COVID-19 Guarantee Scheme (CGS) which provides guarantees to commercial banks to enhance access to bank financing for working capital requirements of businesses facing liquidity shortages because of the pandemic

- COVID-19 Interest Rate Subsidy Scheme whereby all beneficiaries under the CGS are eligible for a grant of up to 2.5% on the interest on the loan (provided under the CGS) for the initial two years of the loan

- COVID-19 Small Loans Scheme, where the MDB provides additional protection to the banks providing loans to smaller businesses.

Furthermore, there was a specific, ad hoc circumstance whereby the MDB provided additional support to a local company. On 8th July 2020, Mediterranean Investments Holding p.l.c. announced that the EC approved a bond subscription facility by the MDB to support the issue of a €20million bond that this company was issuing. Upon the EC’s approval, the MDB was able to cover the part of the bond issue which remained unsubscribed by the market, up to a maximum of €18.7million. The issuer did not make use of this facility eventually, as the bond issue was oversubscribed.

Despite the swift and comprehensive policies implemented by the EU and member states, this disease will continue to have a significant impact on the economy, at least for this year. Many people wonder how long European institutions can keep pumping money to save the economy and whether the temporary framework have to be extended if the outbreak goes on longer than anticipated.

The information presented in this commentary is solely provided for informational purposes and is not to be interpreted as investment advice, or to be used or considered as an offer or a solicitation to sell/buy or subscribe for any financial instruments, nor to constitute any advice or recommendation with respect to such financial instruments. Curmi and Partners Ltd. is a member of the Malta Stock Exchange, and is licensed by the MFSA to conduct investment services business.