By Robert Ducker

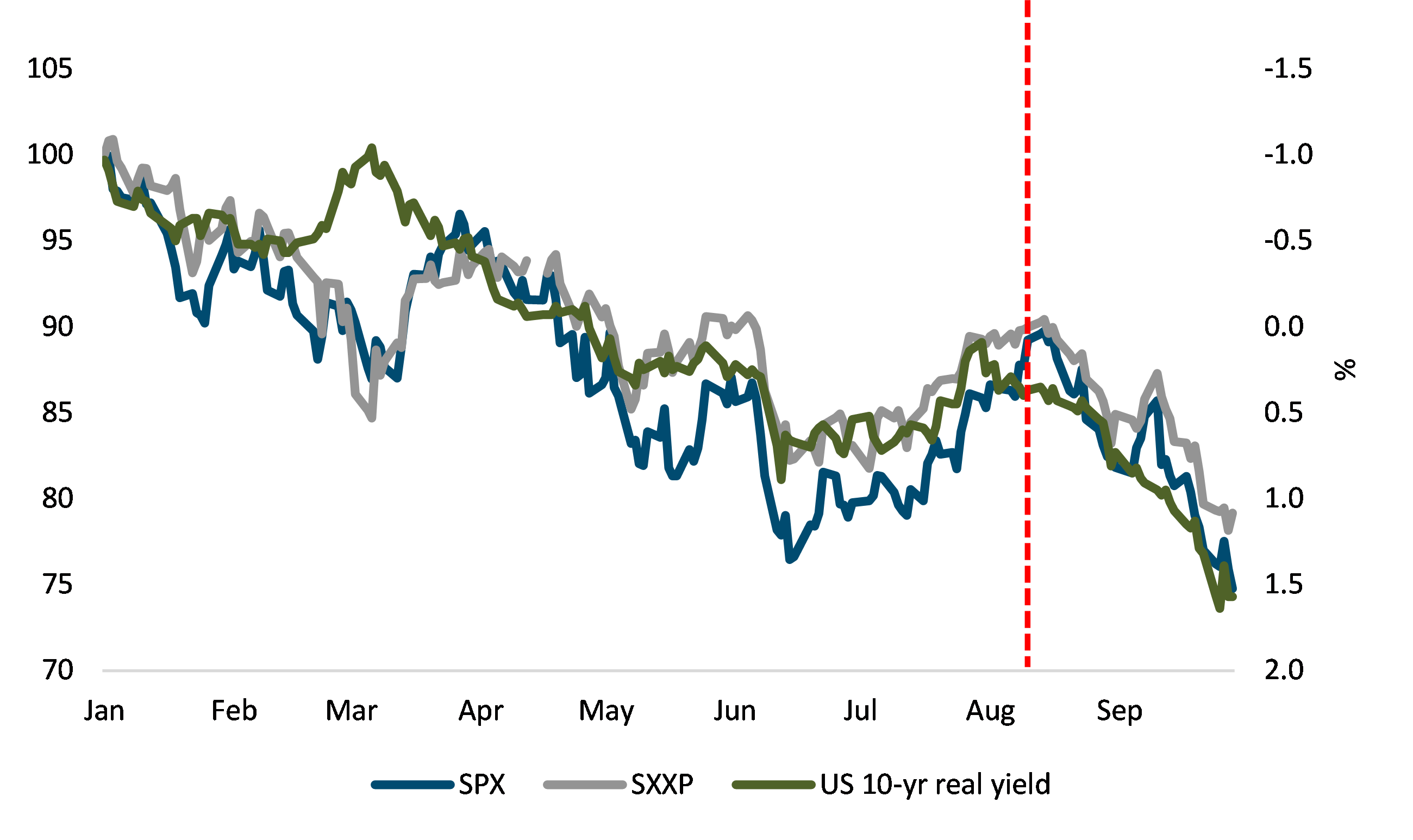

Global equities rallied 14.6% (US$) during the two months ending in mid-August. There was some excitement over whether the summer rally represented the start of a new bull market. Our opinion back then was that “we are currently experiencing an equity market that lacks any meaningful direction” and that “more clarity on the growth and inflation mix” will be needed for a sustained rally in equities (see “Uncertainty not full priced-in” published in the Times of Malta of 14th of August 2022). In fact, such hopes of a new bull market faded quickly, with the FED Jackson Hole symposium effectively signalling the end of the summer rally. The rise in real yields that has followed FED hawkish comments has weighed on risky assets, with global equities losing -16.1% (US$) over the period mid-August to end September.

September has seen heavy, indiscriminate selling in equity markets. Global equities lost -9.3% in September, the worst month since March 2020. There was little room for shelter, with US stocks losing -9.2%, European stocks down 6.4% and UK stocks sliding 5.2% (all in local currency terms). In terms of strategies, global value strategies (-8.4%) outperformed global growth (-10.1%). It was a similar story in the US with value outperforming growth, whilst defensive strategies (-5.8%) outperformed cyclical (-10.5%) as recession concerns increased. Finally, in Europe, investors seemed relatively undecided. Value strategies (-6.1%) and growth (-6.5%) delivered a similar level of performance whilst defensives (-8.5%) marginally underperformed cyclicals (-8.2%).

EM was hit the hardest after a calm first 8 months of the year. Commodity exporting nations helped performance for the asset class during the first 8 months of 2022. EM equities outperformed DM in 5 of the first 8 months of 2022. Yet, global growth concerns as well as the appreciation of the US$ led to a -11.7% decline for the MXEF index during September. As for performance by region, LATAM was again the outperformer with a total return of -3.3%, followed by EMEA at -7.7% and Asia losing 12.8% (local currency terms). The negative performance seen during September now puts EM equities below DM equities in terms of total return for the first time in 2022.

S&P 500, STOXX 600 and US Real yield

The Jackson-Hole Symposium and the hawkish message delivered by the FED in the September FOMC has driven real-rates higher weighing on equity market performance

Source: Bloomberg

Risk sentiment has deteriorated in September. At the start of the third quarter, our main concerns from a macro-economic perspective centred around three issues: The first issue was inflation, and whether demand had cooled sufficiently to enable the FED to slow down the rate hike cycle in the second half of 2022. Secondly, the risk that Russia would cut gas flows to Europe during the winter period, and whether the region would have enough gas reserves for the economy to continue to operate at a normal pace; Finally, China’s growth rate had fallen sharply during the second quarter of 2022 and there was some concern around future lockdowns. Over the course of the third quarter we note that there were negative developments on all three fronts.

A key concern going in FY23 is downward pressure on EPS estimates. The global macro-economic backdrop has deteriorated over the past weeks which should lead to a certain degree of demand destruction. Additionally, we note that inflation could have a negative impact on corporate margins. Yet, consensus is still expecting EPS growth of 3% in 2023 and 6% in FY24. There is a substantial gap between the survey data (PMI) figure, which moved into contraction territory, and EPS estimates which have slowed slightly but are still well above levels normally associated with an economic slowdown. As a rough guide, EPS growth in 2012, when PMI levels were close to levels seen today, came in at -9%, a substantial difference to what is being expected today. Therefore, unless there is a significant recovery in economic activity, we see a risk that FY23 EPS estimates could be revised downwards.

Margins are at an all-time high, but this could change over the coming months. Consensus continues to expect flat margins in 2023 despite (1) higher import raw materials cost; (2) higher cost of debt and debt refinancing for the first time since the GFC; (3) taxation is rising in some sectors; (4) labour cost is rising, which could change if unemployment rises.

The information presented in this commentary is solely provided for informational purposes and is not to be interpreted as investment advice, or to be used or considered as an offer or a solicitation to sell/buy or subscribe for any financial instruments, nor to constitute any advice or recommendation with respect to such financial instruments. Curmi and Partners Ltd. is a member of the Malta Stock Exchange, and is licensed by the MFSA to conduct investment services business.