Article By Robert Ducker

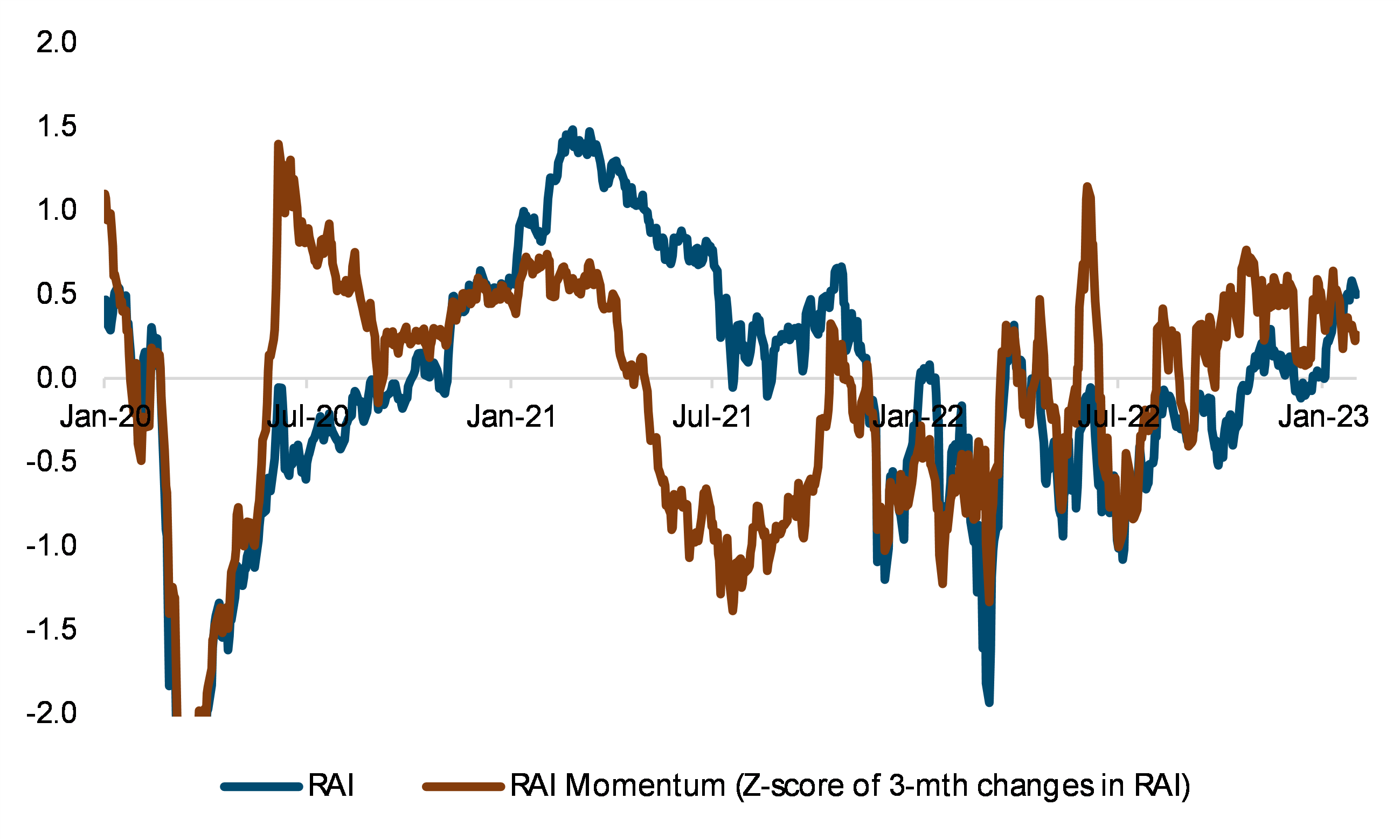

There has been a clear shift in sentiment over the past few months as news flow has turned more positive. Going into 2023 investors feared that economic growth could slow significantly, but three main developments have led to a pick-up in risk sentiment in the opening month of the year: First is China’s rapid re-opening which surprised markets and has boosted its domestic growth outlook. We view this as a positive not only for China’s growth but also for its important trading partners (Europe). Secondly, warmer than expected weather in Europe has sharply reduced its recession risk. Finally, inflation in most developed economies has been falling which could indicate that we have seen the worst in terms of tightening of monetary policy, reducing the risk of a hard landing. These developments led to a pickup in risk sentiment, as evidenced by Goldman Sachs’ Risk Appetite Indicator (“RAI”). After spending most of last year in negative territory, GS’s RAI has turned markedly to around 0.5 and Risk Appetite Momentum is at +0.3 (Exhibit 1).

Exhibit 1 – Risk Appetite Indicator and Risk Appetite Momentum

GS’s RAI has turned markedly positive since the start of the year in view of the improved risk/return dynamic

Source: Goldman Sachs, Bloomberg

Financial markets understandably reacted positively to these developments, but it seems investor focus remained fixed on central bank policy. We can summarize January as a month were rates fell, returns of credit and equities were positively correlated and the Dollar weakened. In short, a typical goldilocks trade. Despite the improvement in the macro-economic backdrop the US yield curve remains deeply inverted and the market is pricing over 200bp of rate cuts from the expected peak in mid-2023. This has buoyed long-duration assets across the different asset classes, including the Nasdaq index which was the best performing index we follow. On the other hand, it weighed on commodities with Brent flat month-on-month despite the better economic expectations and the favourable sector demand/supply dynamics.

Short covering has helped push up equities. The rally in the equity market that started in October has been primarily driven by short covering. This is clearly visible in Europe, where short interest on the STOXX 600 has halved from a recent high. Short positions had increased significantly through 2022, but as the market rallied in the fourth quarter, many investors chose not to roll forward futures in the December expiry, letting them expire.

The hard economic data in the US has been showing no signs of weakening. Employment levels remain at record lows and wage growth remains well above levels consistent with target inflation. On balance, the better news in China and Europe and the resilience shown by the US economy indicates that the growth risk is receding. We think this could push rates higher, weighing on long-duration assets and boosting commodities and assets with a high economic beta.

The macro-economic backdrop is brighter today compared to the end of 2022, but we are not out of the woods yet. The increase in economic activity from the China re-opening, resilient US labour market and warmer than expected weather in Europe which should boost consumer spending could have implications for inflation. We think this is important given the investor attention central bank policy is receiving and the easing in financial conditions seen lately. Also, the situation could change swifty. China could experience a surge in COVID-19 cases forcing fresh lockdowns, temperatures in Europe might drop later than expected and stay cold for longer and the US economy might suffer a lagged impact from the aggressive hiking cycle of 2022. In summary, despite the buoyant mood, risks to the outlook remain.

The information presented in this commentary is solely provided for informational purposes and is not to be interpreted as investment advice, or to be used or considered as an offer or a solicitation to sell/buy or subscribe for any financial instruments, nor to constitute any advice or recommendation with respect to such financial instruments. Curmi and Partners Ltd. is a member of the Malta Stock Exchange, and is licensed by the MFSA to conduct investment services business.