By Somnath Banerjee

Managers of company A conceive a new project which they want to start in two years-time with Internal Rate of Return (IRR) of 5%. Assume current rate of borrowing is 3% for a period of ten years.

The Chief Financial Officer (CFO) think risk free rates are going to move from close to zero to a much higher/restrictive area implying the cost of borrowing for the project in two years-time would be ‘much’ higher.

She proposes to go to the markets now when they can get funding done at c.3% as opposed to an uncertain ‘much’ higher rate in couple of years-time. There are various ways to achieve it. Corporate Finance gurus can achieve a fixed rate revolving credit using some sophisticated financial instruments at ‘some’ cost.

Now, if we are in late 2021, how wise the CFO is and hope she is not overruled by the other C-suitors.

Why is this relevant now? One of the main reasons for bearishness amongst Wall Street analysts with gloomy forecast for equity markets in 2023 was the effect of restrictive rates on credit and its impact on net margins/profitability of companies.

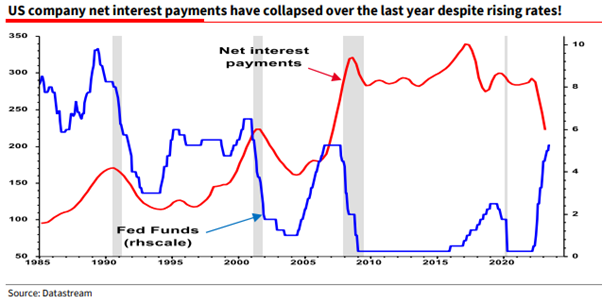

Look at the chart below.

A mere mortal would say there is a positive correlation between policy rates and Interest payments. Not in 2023. It seems all the CFOs are just as smart as the CFO of company A.

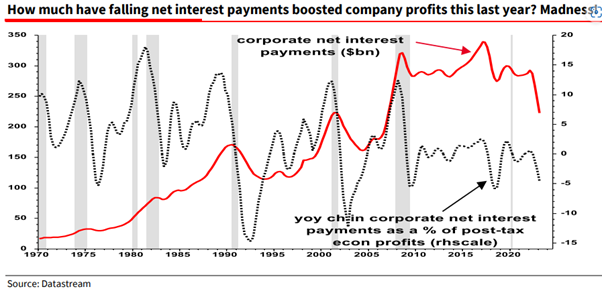

According to Bloomberg a sizeable proportion of huge, fixed rate borrowings during 2020/21 still survives on company balance sheets. Companies have effectively played the yield curve in reverse and become net beneficiaries of higher rates, adding 5% to profits over the last year instead of deducting 10%+ from profits as usual. Hence, it’s not just ‘Greedflation’ that has boosted US profit margins and delayed the recession. Interest rates simply aren’t working as they once did.

In simple words, higher interest payment means lower profits which in essence means a lower valuation. A simple Discounted Cash Flow (DCF) model has cash flows in the numerator (which should have been lower) and cost of debt as denominator (which went up).

One can argue that profit margins did get a lower adjustment in 2023 (c.9% in the US and c.12% in Europe) but didn’t had the desired bearish impact on overall valuation due to two reasons:

- Interest Payment channel didn’t had the same negative impact as expected (explained above); and

- Ample liquidity (Fed balance sheet after dipping marginally in Q1 2023, actually rose after US banking crisis) – Fed put is still on.

Of course, the main reason for equity resilience is on the back of rally driven by Tech sector (read Artificial Intelligence - AI). To begin with rally was pretty narrow (large cap Tech focused on AI, but now the breadth is improving as bears have given up and same professional money who were underweight equities going into 2023 are catching up.

Where does that leave us? Is this rally going to continue? Should you mortgage your house and the rest and buy equities on leverage? The answer to the last question is most definitely “NO.” Now, don’t come and kill me if the equities are up another 20% in a years-time.

I wish I had the answers to the first two questions. But this is what I will say. There are two main reasons in my mind for the rally this year:

- AI driven enthusiasm: The broad argument is AI will increase productivity and hence its extremely positive for valuation of not just AI companies but economy as a whole. Parallels are drawn with tech boom from late 90’s on the back of ‘Internet.’ It surely was ground-breaking when looked at on a two-decade period. But remember tech led bust in 2001 and lot of froth getting settled? The point is I for one do believe the AI will achieve that productivity gains as expected but I am not sure if it will happen without the froth taken out first. Just don’t get caught in that.

- Liquidity: Main reason for equity rally in the last decade, arguably, is liquidity (there is a massive correlation between equity growth and M2 Growth in the developed markets). Bill Gross (of PIMCO fame) who was called the bond king, once said that Fed would never be able to reduce their balance sheet to pre Great Financial Crisis level (c.$1 trillion) as there is so much leverage in the system now that if done, will crash the whole financial system. But that doesn’t mean it’s not coming down from current c.$9 trillion. Fed estimates every $2.5 trillion reduction means c.50bp of tightening.

Bottom line, this equity rally can be justified as above. But it would be wise to pay attention to fundamentals (company balance sheet, management etc.) rather than just buying now into broader equity rally.

Pop Quiz: At the time of penning this piece, DAX was at 15902. Where would it be on close of business 31st August 2023? Send your magic numbers to sbanerjee@curmiandpartners.com with any reasons that you may have. Answers must be submitted before close of business 16th August 2023.

Disclaimer

The information presented in this commentary is solely provided for informational purposes and is not to be interpreted as investment advice, or to be used or considered as an offer or a solicitation to sell/buy or subscribe for any financial instruments, nor to constitute any advice or recommendation with respect to such financial instruments. Curmi and Partners Ltd. is a member of the Malta Stock Exchange and is licensed by the MFSA to conduct investment services business.